Blog

What Is the Duty Drawback Program, and How Can Business Owners Participate?

Importing and exporting between nations is a complex, time-consuming process that requires experienced logistics experts to ensure businesses maintain profit margins, comply with international regulations and fulfill customer orders quickly. For the most part, shipments between nations are subject to trade tariffs or duties paid for at customs before being cleared to enter the country. While most people know about the costs of customs duties, an often overlooked aspect of importing and exporting as a U.S. business is the opportunity for reimbursement on customs duties and taxes known as the duty drawback program.

If you’re not taking advantage of the duty drawback program, you could be leaving money on the table. Knowing what the duty drawback program is, how it works, who is eligible and how to apply will ensure you’re not paying more than you need to.

About the Duty Drawback Program

Businesses importing goods back into the United States may be eligible for financial reimbursements or deductions through the duty drawback program. The duty drawback program is a relatively unknown aspect of American free trade, but it’s meant to encourage and incentivize U.S. businesses to continue to trade among nations and reduce their financial burdens, particularly to prevent being taxed twice.

According to U.S. Customs and Border Protection, the definition of duty drawback is the whole or partial refund, reduction or exemption of customs duties assessed and collected when an item is imported and then subsequently exported back to the U.S. or destroyed. For example, if a U.S. business imports raw materials from Canada, uses those raw materials to manufacture or assemble a final product in the U.S., then subsequently exports that final product to another nation, the business would effectively be paying duties twice on the manufacture of a single product—one tariff on the import and another on the export.

To prevent double taxation, the import fee paid to Customs and Border Protection (CBP) can be claimed as reimbursement. Through the duty drawback process, importers of goods could be eligible for 99% reimbursement or complete waiver of applied customs duties under certain conditions.

To have a better understanding of why the duty drawback program exists, how it works and who it applies to, we need to take a look at how it all started.

History of the Duty Drawback Program

The duty drawback program isn’t a new concept brought in to accommodate recent globalized trade. Its roots date back much further. In 1789, U.S. congressional legislation enacted a provision that offered 99% recovery of duties paid on goods coming into the U.S. that would then be exported elsewhere within the year.

The original purpose of this drawback incentive was to promote enterprise and free trade in the U.S. and among other nations. The drawback program originally had three main objectives:

- Job creation

- Manufacturing incentivization

- Foreign trade and exchange encouragement

At the time of its creation, the program primarily helped fishermen and livestock raisers find relief from expensive duties paid on imported salt used for curing. It also alleviated the expenses of shipbuilders who were aggressively importing raw materials to construct America’s growing fleet. Since its establishment, duty drawback has grown to include dozens of commodities in the manufacturing sector from agricultural products and consumer goods to chemicals and metals.

The Tariff Act of 1930 raised tariffs on hundreds of products in an attempt to increase domestic production during the Great Depression. Despite the Act’s tightening on tariffs, it did add drawback opportunities by introducing the Substitution Manufacturing Drawback — more on that below. During the 1980s, drawback opportunities were addressed again with the addition of new manufacturing scenarios eligible for duty recoveries, such as for automotive assembly and textile manufacturing.

The 1990s saw further amendments to the duty drawback program that included benefits for manufacturers of petroleum derivatives. Manufacturing-related operations like testing, cleaning and repackaging were also determined to be eligible for drawback. The signing of the 1994 North American Free Trade Agreement (USMCA) imposed limitations on American duty drawback privileges when trading with Canada and Mexico. However, the agreement did still allow for duty drawback between the three nations under certain conditions.

Impact of USMCA on Trade Between the Canada, Mexico & the U.S.

USMCA came into effect on Jan. 1, 1994, opening up trade between geographical neighbors to encourage prosperity and the free exchange of goods and services. The agreement was based on the growing consumer demand that would continue to sustain these countries’ economies for the foreseeable future.

The North American Free Trade Agreement was a trade arrangement among North American countries — the United States, Canada and Mexico. These three countries are each other’s most significant trading partners and have developed mutually beneficial relationships that allow for the free flow of goods and services by reducing barriers to trade and streamlining the procedures by which trade occurs between them.

While USMCA intended to stimulate trade among the three nations, it also restricted duty recovery. USMCA limited the type of drawback scenarios that U.S. businesses were eligible for and the amounts they could receive. The United States disqualified manufacturing drawbacks on exports to Canada in 1994 and then did the same thing on exports to Mexico in 2001. Fortunately, some U.S. businesses could benefit from duty drawback in Canada under the Duties Relief Program depending on the importer-exporter relationship. Under this program, Canada would refund businesses the import duties paid, provided those goods were later exported.

Duty Drawback and the USMCA

The three USMCA members negotiated this new agreement between 2017 and 2018. All three heads of state signed the agreement at the 2018 G20 Summit in Buenos Aires, though their legislative bodies have not yet ratified it.

The USMCA is almost identical to USMCA when it comes to duty drawback, though it differs on the issue of de minimis shipment value levels, or the values below which goods can be shipped into a country without the assessment of duties and taxes. Canada has raised its de minimis levels from 20 to 40 Canadian dollars for taxes and will also provide for duty-free shipments of up to CA$150. Mexico will continue to provide a tax-free de minimis of 50 US dollars and will allow for duty-free shipments of up to US$117. The United States agreed to a $100 de minimis threshold under the USMCA, though the threshold under current US law is a much higher $800.

The one change to duty drawback under the USMCA is a change to the exception for sugar. This change expands the exception to include more sugar-containing products.

Duty Drawback Program Eligibility for Importers

Duty recovery can help businesses earn back revenue to reinvest in new manufacturing technology, business development and supply chain solutions. Despite this massive benefit, an estimated 78% of trade transactions eligible for duty drawback go unclaimed. That’s a figure of over $2 billion annually that the government recovers that could go back into the pockets of hardworking business owners.

While many possible reasons for this exist, one of the biggest obstacles preventing companies from claiming their recoverable duty is that they’re simply not aware of the program’s existence. It’s also likely that many business owners and importers are aware of their eligibility for drawback, but they find the application process and record-keeping requirements daunting and perceive it to be more work than it’s worth.

Feeling overwhelmed by the process is no fault of the business owner—the federal government doesn’t exactly promote that businesses can receive a refund on revenue collected at customs. If anything, the CBP attempts to dissuade businesses from claiming duty recovery by reminding them of the time-consuming process of getting their money back. The onus remains on the importer to figure out their level of eligibility, make the application and wait patiently to receive their money back.

You might be surprised at how many importers are eligible for duty drawback. In the current state of international manufacturing and trade, businesses take advantage of various points of operation to produce and assemble products in stages based on where it’s most economical to do so. While the duty drawback program is most commonly thought of as it applies to manufacturing businesses, there are actually a few fundamental scenarios where duty drawback applies.

As of right now, the current duty drawback program applies in the following four main scenarios, and each has a 99% drawback:

- Manufacturing merchandise drawback: Also known as Direct Identification Manufacturing drawback, the manufacturing merchandise drawback is typically the most common scenario eligible for duty drawback. The easiest way to think of it is that these are items shipped to one country that are not for end-use in that country. When items are shipped to America from another nation and then subsequently shipped to another country again, the importer who paid the customs duties and taxes could be eligible for reimbursement or waiver. This often occurs when goods are shipped to one country that’s used as the assembly or manufacturing hub. The goods are refitted, remodeled or finished by a business in that country, then the final product is shipped to another nation elsewhere in the world.

- Substitution manufacturing drawback: Substitution applies to manufacturers who make products using a mix of imported items and domestic items of the same type and quality. When their final product is then exported or destroyed, they can claim duty drawback regardless of whether the item exported was made from the foreign components or the domestic components. This scenario is intended to help manufacturers cut down on the steps in their inventory management, relieving them from having to maintain two separate inventory counts for foreign and domestic parts.

- Unused merchandise drawback: If a business imports merchandise into the United States and then subsequently exports an unused portion back to the country of origin in its original (unused) condition, the business can have a portion of the import fees reimbursed.

- Rejected merchandise drawback: In this scenario, either the importer was accidentally sent the wrong goods or, when the items arrived, they weren’t in suitable condition for sale or use. When this occurs, the items get rejected or destroyed, depending on the industry. Because the items weren’t able to be used, the importer doesn’t have to pay the duties on them, and the business is eligible for a reimbursement on duties paid.

Duty drawback is heavily applicable to the manufacturing sector, which is often faced with market volatility, especially when trading on a global scale. For this reason, some of the most common commodities reaping the benefits of duty drawback over the years have been:

- Pharmaceuticals and medical devices

- Alcohol and beverages

- Agricultural products

- Steel and metal alloys

- Automotive and aviation components

- Textiles, clothing and fabric

- Petroleum and derivatives

- Petrochemicals and industrial chemicals

- Packaged and consumer goods

- Packaging materials

Be sure to ask your supply chain solutions provider if your commodity or class of goods is eligible for the duty drawback program.

How to Apply for the Duty Drawback Program

The duty drawback program has had several iterations over the years, and the requirements and processes for applying have also changed. The most recent changes came at the end of 2018. On Dec. 17, 2018, new rules and procedures for duty drawback came into effect under the Trade Facilitation and Trade Enforcement Act (TFTEA) of 2015. According to the latest updates, all duty drawback applications are now required to be filed electronically. Additionally, business owners now have five years from the import date to the filing date to apply for duty drawback and must provide proof of export to qualify.

Businesses that import and export as defined by the four main scenarios eligible for drawback duty can apply for reimbursement. Here’s a snapshot of the current procedure for claiming duty drawback and facts about duty drawback:

- Maintain accurate record-keeping, including invoices, shipment receipts, cash receipts, exportation documents and transfers of merchandise.

- Maintain your records for another three years following the date of export.

- File for duty drawback within five years of the date you imported the goods.

- Apply for duty drawback online only.

- Receive 99% refund on duties, taxes and fees.

- Receive reimbursement on the country’s duties that were the lesser amount when third countries are involved.

If you have any questions about the duty drawback program, you can contact the CBP at their duty drawback locations. There are four duty drawback centers across the U.S.:

- Chicago, Illinois: 5600 Pearl Street, Rosemont, IL 60018 — (847) 928-8070

- Houston, Texas: 2350 N. Sam Houston Parkway East, Suite 1000, Houston, TX 77032 — (281) 985-6890

- Newark, New Jersey: 1100 Raymond Boulevard, Room 310, Newark, NJ 07102 — (973) 368-6950

- San Francisco, California: 555 Battery Street, Room 109, San Francisco, CA 94111 — (415) 782-9245

These duty drawback centers are fully staffed with claims personnel who can assist you in applying and filing for duty recovery.

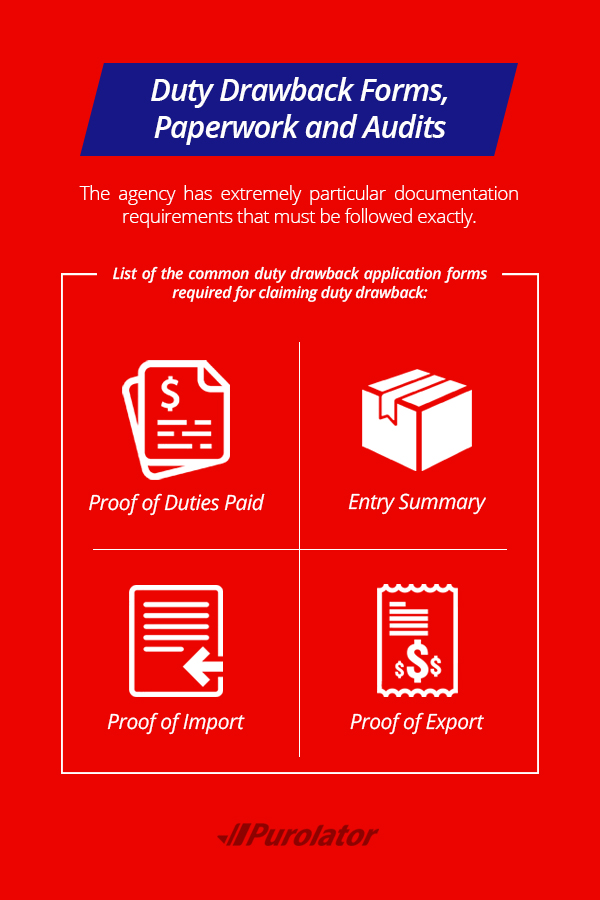

Duty Drawback Forms, Paperwork and Audits

Though the duty drawback process might seem straightforward, the challenging part is being able to satisfactorily prove your eligibility to CBP. The agency has extremely particular documentation requirements that must be followed exactly. All documents must be kept for at least three years following the final export, and all entities involved in the supply chain must also keep their records.

Here is a list of the common duty drawback application forms required for claiming duty drawback, depending on which drawback scenario applies to your situation:

- Proof of Duties Paid: Importers of goods and any manufacturers who purchased imported goods need an official Certificate of Delivery to prove they received and paid duties on the goods they later exported. Businesses can prove delivery and duties paid with Customs Form 7552 – Delivery Certificate for Purposes of Drawback. The Delivery Certificate for Purposes of Drawback is the most important proof that you did pay import duties on the goods that you’re seeking to recover.

- Entry Summary:Customs Form 7501 is the Entry Summary form that’s used to determine relevant information about the shipment. Imported commodities are allocated an Entry Number, which the CBP uses for tracking purposes.

- Proof of Import: Proof of import is demonstrated using the official CBP Customs Form 7551. This document lists the shipment contents and tariff classification code (which determines duty amount paid). It’s also necessary to keep the invoice that accompanied your shipment for a more in-depth description regarding the shipment and its contents.

- Proof of Export: Proving that your business exported the goods can come from documents like a shipment invoice, shipment declaration or bill of lading.

In addition to official government forms, your business and all parties involved in the manufacturing and supply chain process will need to retain other documents required for claiming duty drawback, including:

- Commercial/sales invoices

- Purchase orders

- Receiving reports

- Dated delivery records

- Payments documents

- Cash receipt records

- Inventory records

- Proof that items were used in manufacturing with dates

- Possible proof of waste value

- Shippers export declaration

- Export invoices

- Export bills of lading

Even if you fill out all required customs forms properly and maintain all of the above records and more, you may still be contacted for further documentation requests. CBP agents might submit a request for further clarification to be submitted by mail. Or, in rare cases, they may wish to do an on-site compliance review. Agents may also request face-to-face meetings to further ensure compliance.

Because audits do happen, business owners must be prepared to demonstrate every step of their importing, manufacturing and exporting processes. Separate divisions and entities must also work together and stay on the same page when it comes to record-keeping standards.

Because of the complexities involved in duty drawback record-keeping, most businesses interested in duty recovery end up hiring an experienced customs broker to handle the duty drawback process on their behalf. The benefit usually far outweighs this expense.

Top Takeaways for Business Owners

While the duty drawback program has tremendous financial benefits, it’s also a time-consuming, complex process that may require expert help to successfully complete. Business owners interested in working with a logistics solutions provider to file for duty drawback should also have a good understanding themselves of the program and how it pertains to their manufacturing and supply chain processes.

Here are some top takeaways that business owners should know about the duty drawback program:

- Maintaining organized and complete records is essential to getting your money back. If you’d like to apply for duty drawback, make record-keeping your number one priority.

- Legally, only the exporting company of record is entitled to receive the drawback. As an exporter, you can endorse the drawback rights back to the manufacturer if you’re two separate entities.

- Once your drawback claim is under CBP review process, it can take several years before it’s complete, and you receive your money.

- Businesses can receive their money faster by getting pre-approval from the CBP through the accelerated payment program. Pre-approval can allow you to get your money back in as little as a few weeks.

- CBP is clear — the duty drawback program is a privilege, not a right. Your application approval is not always guaranteed.

Navigating the process of duty drawback can be grueling and might seem like it isn’t worth the effort. But if your business is regularly paying thousands of dollars in import duties, that’s money you could use to reinvest into your business. Experienced logistics professionals can take care of the duty drawback process for you removing the barriers to getting your money back.

Partner With Purolator International for Help With Duty Drawback Applications

Unclaimed duty recovery can be avoided by using a professional and experienced customs broker and freight forwarding company. Purolator International is a U.S.-based supply chain solutions provider with over 20 years’ experience in navigating international trade between Canada and the U.S. We pride ourselves on helping U.S.-based businesses like yours make it easier — and more affordable — to do business with Canada. Helping our customers find financial relief by claiming duty drawback is one way we achieve this.

When you choose Purolator International for all your shipping solutions needs, you’ll get the help of duty drawback experts who can assist in the application process. Our logistics professionals are duty drawback experts. They know ahead of time whether your business is eligible for duty drawback or duty relief in Canada and can guide your submission of the pre-approval application.

If you’re ready to claim what’s yours and put more cash back in your pocket, contact Purolator International today. We can help answer all your duty drawback questions and provide a better understanding of the requirements and incentives in exporting and importing to and from Canada. Call Purolator International today at 1-888-511-4811. Or reach us online to find out how we can be your solutions provider for smoother shipments between the U.S. and Canada.