Blog

The ABCs of CBP’s Single Window Initiative

Desperately needed relief arrived for U.S. importers and exporters in January 2017 when the U.S. Customs and Border Protection (CBP) agency’s “Single Window Initiative” (SWI) was fully implemented. The initiative, officially known as the “International Trade Data System” (ITDS), which had been in the pipeline for more than two decades, is poised to streamline the border clearance process by providing a single venue through which all shipment data and documentation will be entered and managed.

The Single Window effectively replaces a multitentacled process marked by redundancy, inefficiency, and red tape; the process has been a significant and growing source of frustration for the trade community. As the CBP agency itself noted: “Forty-seven agencies are involved in the trade process, and among these agencies, nearly 200 forms are required for imports and exports. The current processes are largely paper-based and require information to be keyed into multiple electronic systems. As a result, importers and exporters are often required to submit the same data to multiple agencies at multiple times.”

“Forty-seven agencies are involved in the trade process, and among these agencies, nearly 200 forms are required for imports and exports…” – Source: ACEopedia, U.S. Customs and Border Protection

While CBP has long recognized the need to revamp and modernize its capabilities, namely through an electronic filing platform called the Automated Commercial Environment (ACE), the issue came to head in 2014 when President Barack Obama put the issue firmly on CBP’s front burner through an executive order, directing the completion of an electronic Single Window by December 2016.

Going forward, the Single Window — which operates via the ACE platform — is the only platform through which cargo information can be submitted. All other previously maintained databases and filing systems have either been deactivated or will be in the near future.

Throughout the development process, CBP communicated regularly with U.S. businesses, providing updates and urging them to become familiar with evolving system capabilities. The Single Window — through the ACE platform — was introduced incrementally, with different government agencies, known as Partner Government Agencies (PGAs), coming online at different stages. CBP was methodical in addressing the specific needs of each agency. Import requirements for the Food and Drug Administration, for example, are very specific and different from Consumer Products Safety Commission requirements.

Following is an overview of ACE and the Single Window process, including important information about what the new filing system means for U.S. businesses. Going forward, shippers will benefit from an easier process with existing bottlenecks largely eliminated.

But ACE is more than just a way to streamline the import/export process. It is an integral part of CBP’s strategy to strengthen border security through advance knowledge of incoming shipments. This advance knowledge allows CBP to make informed resource allocation decisions to ensure that high-risk, suspect shipments are afforded greater attention, while low-risk shipments can be quickly cleared for entry.

Important to note is most businesses entrust customs compliance responsibility to an experienced logistics provider or customs broker. While this is generally a smart decision, since it alleviates the need for a business to expend internal resources on customs compliance, a general understanding of ACE functionality is useful. Among other reasons, a business is liable for all information submitted to CBP on its behalf.

Understanding Single Window — A Few Essential Terms

Before a shipper can ensure compliance with Single Window requirements, it’s necessary to have familiarity with, and a basic understanding of, key terminology. Terms commonly associated with Single Window include:

- Automated Broker Interface (ABI): The ABI was initially developed to allow electronic filing of required trade data into the Automated Commercial System and will continue to provide this critical function for ACE filings. According to CBP, more than 96 percent of all customs entries are filed through ABI.

- Automated Commercial Environment (ACE): This is the “technology backbone” for the Single Window Initiative and the U.S. government’s primary system for processing import/export information. ACE was developed to replace the Automated Commercial System, which had become outdated. Members of the trade community are required to file all customs-related information via ACE prior to a shipment’s arrival at the border. This advance notification allows CBP to assess each shipment and designate resources based on risk. ACE is the platform for the U.S. government’s Single Window Initiative, which, as of January 2017, became the single filing system for CBP and all partner agencies.

- Automated Commercial System (ACS): ACS was the first Electronic Data Interchange (EDI) system developed by CBP as a way to facilitate the customs process. ACS was developed by CBP in response to a mandate from Congress, espoused in the 1993 Customs Modernization Act (the Mod Act), to allow for electronic transmission of customs documentation.

ACS served its purpose until gradually becoming outdated. In 2003, CBP announced testing of the initial stages of the Automated Commercial Environment (ACE), which would be phased in and gradually replace ACS. CBP announced in a February 29, 2016, Federal Register notice that it had begun the process of “decommissioning” ACS, and as of May 2016, ACS was no longer “a CBP-authorized EDI system for purposes of processing electronic filings.” - International Trade Data System (ITDS): ITDS is the “Single Window,” the primary system through which the trade community submits import and export documentation required by CBP and the 47 PGAs with control over the trade process. The ITDS was authorized by Congress via section 405 of the SAFE Port Act of 2006 as a way to “eliminate redundant information filing requirements, efficiently regulate the flow of commerce, and effectively enforce laws and regulations relating to international trade by establishing a single portal system, operated by CBP, for the collection and distribution of standard electronic import and export data required by all participating federal agencies.”

- Partner Government Agencies (PGAs): In addition to CBP, 49 government agencies have responsibility for the import/export process. These agencies are called Partner Government Agencies (PGAs), and CBP enforces documentation and trade regulations on each agency’s behalf. Prior to the SWI, no process was in place to streamline agencies’ overlapping documentation requirements. As a result, shippers were required to submit identical data and documentation, multiple times, to satisfy each applicable agency’s requirements. The SWI eliminates this onerous burden by allowing shippers to input data once, whereupon ACE will automatically transmit the information to each stakeholder PGA.

- Single Window Initiative (SWI): Officially known as the International Trade Data System, the Single Window Initiative is the system through which the trade community reports shipment information and the government determines admissibility. According to CBP, “through ACE as the Single Window,” manual processes are streamlined and automated, paper is eliminated, and the trade community is able to more easily and efficiently comply with U.S. laws and regulations.

Key Benefits of the Single Window Initiative

When President Obama signed Executive Order 13659, mandating completion of the International Trade Data System by December 2016, he cited the damaging effect of existing processes on the nation’s trade community. “Today, businesses must submit information to dozens of government agencies, often on paper forms, sometimes waiting on process for days to move goods across the border,” the statement accompanying the executive order read. “The new electronic system will speed up the shipment of American-made goods overseas, eliminate often duplicative and burdensome paperwork, and make our government more efficient.”

According to CBP, specific benefits of the Single Window include:

- Streamlined submission of all shipment information to CBP and PGAs

- Elimination of all paper documentation — everything is electronic

- Faster processing, since CBP agents are able to allocate resources based on risk assessments

- Enhanced visibility of shipment and cargo status through ACE-generated status messages

- Capability for electronic post summary corrections

- Decreased administrative costs

- 24/7 access to online records

- Capability to run more than 60 downloadable reports

- Online payment capability for duties and fees

- Enhanced border security

How Does It Work?

For many in the trade community, ACE — and the Single Window it provides — is a dream come true. And news that the system is now the law of the land will hopefully not come as a surprise.

This is because, for the past several years, CBP has communicated regularly with the trade community about ACE development, with clear updates about testing phases and compliance dates, and steps required to get ready. In November 2015, for example, CBP announced the beginning of a “voluntary compliance period,” during which members of the trade community were encouraged to familiarize themselves with ACE functionality by using available capabilities, establishing user accounts, and offering feedback about the system’s capabilities.

In April 2016, electronic filing of import data via ACE became mandatory, with different government agencies scheduled to come on board in the following months. The Food and Drug Administration (FDA), for example, became ACE-compliant in June 2016, meaning information that had previously been submitted via ACS was now transmitted directly via ACE.

ACE Features

ACE functionality permits electronic processing for shipments arriving across all venues, with capabilities for manifest, cargo release, entry summary, exports, and protests.

Manifest

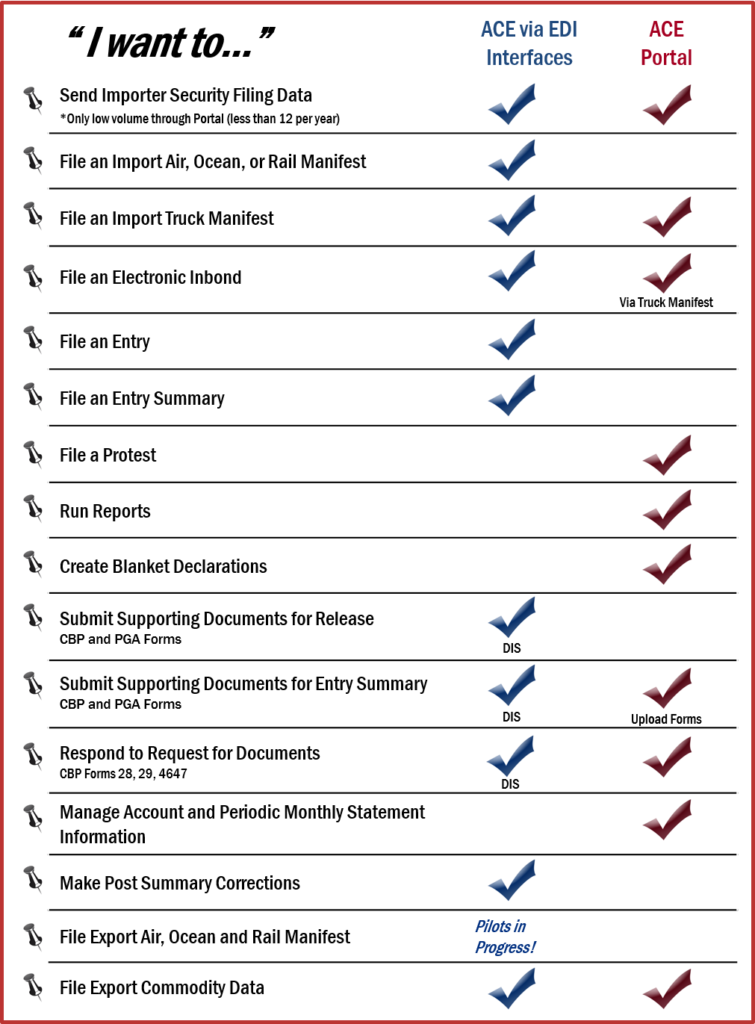

Manifests for all modes of transportation — truck, ocean, rail, and air — must be filed in ACE prior to a shipment’s arrival at the border. Truck carriers are able to file manifests via the ABI/Electronic Data Interchange (EDI) and the ACE Secure Data Portal, while ocean, rail, and air manifest data can only be transmitted via ABI/EDI.

Among the key benefits identified by CBP for ACE manifest capability are:

- Status message replies sent via ABI/EDI

- Reduced wait times for processing at ports of entry

- Elimination of paper filing requirements

- Enhanced visibility of cargo status through update messages

- Ability to designate a list of authorized partners who can use carrier custodial bonds

Cargo Release

According to CBP, the agency streamlined the cargo release process by working with representatives of the trade community to compare data elements necessary for releasing cargo with data available during the pre-departure environment. “The result of this work,” CBP notes, “is a reduced data set consisting of fewer required data elements.”

Among the benefits of the revamped cargo release process are:

- Streamlined submission of data elements

- CBP Form 3461 no longer necessary

- Ability for CBP and PGA personnel to provide enhanced security, safety, and compliance through faster processing

- Changes can be submitted electronically

- More efficient and effective collection of fees

- Expedited release

- Remote location filing

- Ability to submit partial quantities and file in-bonds

Entry Summary

Electronic entries must be filed in ACE for all entry modes. In addition, filers can also submit post-summary corrections, and utilize ACE capabilities to edit information, as a way to validate data accuracy and alert users about data errors.

Among the benefits of ACE’s entry summary capabilities are:

- Decreased courier and administrative costs

- Paper processes replaced by electronic post summary corrections

- Reduced invoice transmissions through census overrides

- Enhanced validation calculations for:

- Harbor maintenance fees

- Classification

- Simple and complex duty calculations

- Merchandise processing fees

- Informal entry restrictions

- Charges restrictions

- Taxes and other fees

- Electronic capabilities for managing and processing:

- Reconciliation

- Drawback

- Liquidation

- Statements

Protests

Through ACE, CBP has modernized the process for submitting and managing decision protests. Going forward, protest filers (e.g., attorneys, brokers, importers, etc.) can electronically submit protests and attach supporting documentation electronically instead of via paper packets. In addition, protest submissions can be updated electronically with additional or modified information.

Key benefits of electronic protest submission capability include:

- Elimination of paper

- Ability to secure date/time electronically stamped submissions

- CBP will immediately acknowledge receipt of materials and assign case number

- Ability to view real-time status

- Ability to receive email notices from CBP

- Note: To file protests in ACE, a user must establish a “protest filer account” within the ACE Portal. Users with an existing ACE Portal account can add the protest account capability.

Exports

Prior to ACE, all export documentation was filed through the Automated Export System (AES). But as of March 2014, AES functionality was transferred to ACE, and ACE is now the primary filing system for exporters. According to CBP, by working with partner software vendors, exporters are able to interface with ACE to file all necessary export data and supplementary information.

How Do You Participate?

The first step in ACE compliance is to become familiar with the two technology systems that drive the process, the Automated Broker Interface (ABI)/Electronic Data Interchange (EDI) and the AES Secure Data Portal:

- ACE Secure Data Portal: The ACE Secure Data Portal is a customized web-based application that gives users the capability to view their account information and transactional data. It is also the venue through which electronic truck manifests can be filed. The ACE Portal also allows users to compile data and run reports, and to access their periodic monthly statement, which facilitates the payment of duties and fees. To gain access to the ACE Portal, a business must have an account, which can be obtained by submitting an application to CBP.

- Automated Broker Interface (ABI)/ Electronic Data Interchange (EDI): EDI is an electronic communication framework that provides standards for exchanging data via any electronic means. For ACE filings, the existing Automated Broker Interface (ABI) will be the method through which information is transmitted to CBP. Electronic communication through ABI allows trade filers to receive faster decision responses for the movement of cargo. Business entities that wish to communicate via ABI to CBP may use an approved software provider, become a self-filer, or enlist the services of a third party. With the exception of filing an electronic truck manifest (which is filed through the ACE Portal), ABI is the only mechanism through which transactions (entries, entry summaries, and ocean and rail manifests) can be filed in ACE. Any party wishing to transmit data via ABI will need prior approval from CBP. To initiate the process, CBP recommends contacting a trained CBP client representative by sending an email to the following address: [email protected]. To obtain access to the ABI, a business must submit a letter of intent to CBP that provides detailed information about its history, operations, and capability.

For businesses that will not link directly via an EDI interface or an ACE Portal account, CBP suggests proactively ensuring that their logistics provider has the necessary systems in place to perform necessary ACE-required data filings.

How Can a Business Ensure Compliance?

The Single Window Initiative was in the development stages for many years, and during that time, CBP provided numerous updates to members of the trade community. CBP updates included key information about system capabilities and implementation dates. The reason for communicating this information was to keep the trade community informed and to encourage filers to prepare for the eventuality of mandatory ACE filings.

Smart businesses heeded this advice and took steps early on to prepare. These businesses opened accounts in the ACE Portal and conducted extensive testing to ensure seamless filings. In addition, necessary software upgrades were implemented, with extensive testing conducted to ensure full functionality.

Since most businesses rely on a logistics provider or a customs broker to submit documentation to CBP on their behalf, it’s important to ensure that a provider is well versed on ACE filing deadlines and systems requirements. In other words, you want to sign on with a trade partner that heeded CBP’s advice to proactively get ready for ACE. An ACE-prepared logistics provider will already understand the intricacies of the Single Window and be prepared to ensure a seamless filing process for its customers.

Penalties for Non-Compliance

Similar to other government programs, failure to comply with ACE filing mandates could result in fines and penalties. According to BluJay customs management firm, “the master of any ship, driver of any vehicle, or the pilot of any aircraft found not to be in compliance with the advance notification rules will be subject to a monetary fine.” A first-time violation will trigger a fine of $5,000, and subsequent violations will trigger fines of $10,000.

While these are not insignificant amounts, the major impact could be felt in the clearance delays likely to result from missing or incomplete filings. “Missing data will generate an immediate fail, which will result in goods being turned away or detained with the associated additional costs, including labor, storage, and fuel, while the situation is resolved,” BluJay warns customers.

In fact, the overall impact of having a shipment delayed at the border could easily run into tens of thousands of dollars and have an impact that could reverberate throughout an entire supply chain. There is much to lose by not complying, and there is much to gain from successful ACE participation.

Single Window/ACE and International Trade?

As much as the SWI will facilitate the import and export process for the U.S. trade community, much of its functionality cannot be shared with the rest of the world. It is, in effect, an American-made product not eligible for export. This is because ACE was built to meet the specific needs of the U.S. government and trade community.

Similar Single Window Initiatives are in place in dozens of countries around the world, with the World Customs Organization (WCO) — the Brussels-based organizations charged with maintaining the international trade community’s listing of tariff classifications — citing in its 2015– 16 Annual Report that more than 50 percent of the world’s customs administrations use Single Window systems. WCO assists countries in developing Single Windows and maintains a library of initiatives in place around the world. In some instances, Single Windows can be integrated among nations. The ASEAN Single Window, for example, connects the national Single Windows of each of its 10 member states.

Closer to home, the United States and Canada are considering steps to integrate their trade processing systems to the extent feasible. With almost $600 billion worth of goods crossing the U.S./Canadian border annually, the trade community has long complained about redundancies in the customs process. Shippers are often required to submit identical documentation and shipment information both to the U.S. CBP and the Canada Border Services Agency (CBSA).

Efforts to streamline data collection processes received a boost in early 2011 when U.S. and Canadian leaders announced the Beyond the Border initiative, which, among many provisions, committed each country to development of a Single Window that would then be used, where possible, to integrate data between the two countries.

Canada’s Single Window, which will operate from the Advance Commercial Information (ACI) trade-processing center, is scheduled for full implementation in early 2017. However, a government-sponsored audit found the trade community has been slow to implement Single Window processes. “The Canada Border Services Agency anticipated that within Single Window’s first year of operation, eight members of the trade community, representing 40 percent of regulated goods, would be using Single Window. We found that as of May 2016, only one of those members, representing 17 percent of regulated imports into Canada, was using Single Window,” the audit noted.

The report further noted that adoption of Canada’s Single Window has been slower than expected because it is not mandatory and because traders must make a considerable investment in technology in order to use the system. While certain progress has been made in facilitating certain aspects of the cross-border trade process, it seems traders will have to wait a bit longer for the meaningful relief they expected from the Single Window Initiatives.

Conclusion

The U.S. Commerce Department estimates that less than 1 percent of America’s 30 million companies export, and of those that do, 58 percent export to only one country. When asked why, companies cite a range of issues, but concerns about the “complicated process” and “overregulation” consistently top the list.

This is why final implementation of the International Trade Data System — aka the Single Window Initiative — is such good news for the trade community. With the Single Window in place, traders are freed from the redundancies and confusion that too often defined the customs process.

CBP Deputy Commissioner Kevin McAleenan referred to the Single Window as a “shining example” of the progress made possible by technology while addressing a December 2016 trade symposium. “It serves as the foundation of the coordinated border concept: to enable the entire U.S. government to work together across departments and agencies through a coordinated approach to move imports and exports rapidly and securely across our borders,” McAleenan added.

As U.S. businesses adjust to the new reality of Single Window processing, traders will soon wonder how they ever got along without this tremendous milestone.

Purolator. We deliver Canada.

Purolator is the best-kept secret among leading U.S. companies who need reliable, efficient, and cost-effective shipping to Canada. We deliver unsurpassed Canadian expertise because of our Canadian roots, U.S. reach, and exclusive focus on cross-border shipping.

Every day, Purolator delivers more than 1,000,000 packages. With the largest dedicated air fleet and ground network, including hybrid vehicles, and more guaranteed delivery points in Canada than anyone else, we are part of the fifth-largest postal organization in the world.

But size alone doesn’t make Purolator different. We also understand that the needs of no two customers are the same. We can design the right mix of proprietary services that will make your shipments to Canada hassle-free at every point in the supply chain. Contact us today!