Blog

Canada Tightens Customs Procedures, Increases Penalties After Audit Report

U.S. businesses that ship to Canada will have an unwelcome surprise awaiting them should they run afoul of Canadian customs mandates. In March 2019, the Canadian Border Services Agency (CBSA) announced plans to increase penalties for commercial importers after an internal audit found the agency’s existing penalty structure was not sufficient to deter noncompliance.

The audit, conducted by the Office of the Auditor General of Canada (OAG), reviewed CBSA practices with regard to management and collection of customs duties. In an accompanying report released in March 2017, CBSA was cited for its inability to “accurately assess all customs duties owed to the government on goods coming into Canada.” Further, the report noted, “this was due in part to the agency’s selfassessment system, which may have allowed importers to be noncompliant with import rules and regulations, and in part to the agency’s own internal challenges relating to staffing.”

Specifically, the report found about 20 percent of goods were arriving at the border with an improper tariff classification code assigned, that most goods did not list useful product descriptions, and that CBSA’s self-assessment processes have allowed importers to take advantage of lax oversight. All this has added up to an annual loss of at least C$42 million in uncollected duties or in funds reimbursed to traders who file amended post-entry claims.

In addressing the audit’s findings, CBSA President John Ossowski told Parliament’s Standing Committee on Public Accounts that his agency “takes this report’s findings seriously, and our actions speak to this.” He noted the onerous impact eCommerce has had on CBSA’s ability to keep pace with the surge in shipments — many of them eligible for low-value duty and documentation exemptions — arriving each day. “Right now, we have over 300,000 postal and courier shipments per day coming into the country,” Ossowski explained. “What’s hard about this, particularly with the eCommerce aspect of it, is that we don’t often get, in the postal mode, the advance information and clear description of what the good is to allow us to make the proper assessment.”

An investigation by the Office of the Auditor General of Canada reviewed CBSA’s ability to accurately assess customs duties.

CBSA has apparently taken the OAG audit findings to heart by announcing initiatives to strengthen border compliance effectiveness and efficiency. In addition to increasing fines for violations, the agency is considering additional action, including reducing the amount of time — currently four years — that an importer has to submit retroactive adjustments to previously submitted documentation.

CBSA has also indicated plans to address the audit’s criticism of the way in which customs brokers are licensed and evaluated. Specifically, the audit found lax oversight of Canada’s 286 customs brokers who collectively oversee 68 percent of all imports arriving at the border.

Since documentation submitted to CBSA is ultimately the responsibility of the shipper — and not the customs broker or logistics provider acting on its behalf — U.S. businesses have an interest in learning about CBSA’s increased focus on compliance and the potential financial impact for inadvertent violations.

The following discussion focuses on specifics of the OAG customs audit and steps CBSA has announced to address those findings.

CBSA Customs Audit — Findings and Recommendations

The stated purpose of the Office of the Auditor General’s investigation was to focus on whether “the Department of Finance Canada, Global Affairs Canada and the Canada Border Services Agency adequately managed customs duties according to their roles and responsibilities.” These three agencies were selected because of their direct role in collecting duties:

- Canada Border Services Agency oversees the importation of goods into Canada and administers more than 90 acts, regulations, and international agreements. In addition, CBSA is responsible for assessing duties and taxes owed to the Canadian government.

- Department of Finance Canada develops and administers the Customs Tariff classification listing and implements trade and tariff policy. There are more than 7,400 classes of goods listed in the Customs Tariff. Importers must assign the correct 10-digit classification number from that listing to identify each imported good.

- Global Affairs Canada is responsible for overseeing the importation of certain goods into Canada that require an import permit, such as beef, chicken, and dairy products

As the agency responsible for overseeing the importation of goods into Canada, the Canada Border Services Agency (CBSA) was the primary focus of the Auditor General’s report.

With regard to CBSA, the audit cited several reasons for the agency’s poor performance in properly assessing customs duties, including:

- CBSA’s self-assessment system

- Improper tariff classification coding

- Improper product descriptions

- Lack of oversight for quota-controlled goods

- Excessive time period for submitting retroactive claims

- Failure to monitor qualifications of customs brokers

- Agency internal staffing-related challenges

CBSA’s Self-Assessment System

CBSA simplifies the border clearance process for low-risk, pre-approved importers and carriers through the Customs Self Assessment (CSA) Program. To be eligible, program participants must first undergo a rigorous application and examination process. According to the Chartered Professional Accountants of British Columbia trade association, once approved by CBSA, CSA members use their own commercial business systems to initiate customs accounting and self assess customs duties. In addition, CSA importers are exempt from many documentation requirements, which means less scrutiny at the border and a significantly faster clearance process.

However, the Auditor General found the very attributes that make the program so successful have helped drive up incidences of noncompliance and duty avoidance. Specifically, the audit described a situation in which shipments are often uninspected and enter Canada without all required import forms.

Because of the relative ease with which selfassessed shipments clear the border, CBSA is often unable to accurately evaluate post-entry revisions. The audit found that during FY 2014- 15, importers initiated 200,000 adjustments and were issued refunds totaling C$136 million. “In our view,” the report noted, “this situation allowed importers to circumvent paying required duties.”

Improper Tariff Classification Coding

Products arriving at the Canadian border must be assigned a 10-digit tariff classification code as listed in the Customs Tariff schedule. With thousands of codes from which to choose, determining the correct classification can be difficult. But, according to CBSA, there is only one correct classification for each item, and the onus is on the importer to identify and document that code.

…as many as 20 percent of shipments arrive at the border bearing an improper tariff classification code…

However, the audit determined as many as 20 percent of shipments are improperly coded. Based on FY 2015-16 information, this resulted in an underpayment of an estimated C$42 million in customs duties. Not stated was the amount of duties that were presumably overpaid as a result of misclassified shipments.

Auditors also found an alarming number of instances in which shipments containing a diverse array of products — as many as 50 — were grouped together under a single classification code. Not only does this erroneous practice have financial implications but, the audit found, it can prevent customs agents from knowing precisely what goods are being imported.

Improper Product Descriptions

Shipments arriving at the Canadian border must include a “clear and concise description” of each item. The description should be in plain language and detailed enough to allow CBSA agents to identify the size, shape, and characteristics of the cargo. To assist in the process, CBSA provides an overview of “acceptable/not acceptable” examples. Listing a shipment as an “appliance,” for example, is not acceptable. Instead, the description should be expanded to include “refrigerator,” “coffee machine,” or “microwave oven.” Similarly, auto products should be described as “air filters,” “automobile brakes,” or “automotive windshield.”

However, the audit found a high incidence of shipments that either lacked a product description entirely or included one that was inappropriate. The report examined 1.4 million records, of which 74 percent did not provide a description that allowed auditors to determine if the assigned tariff code was correct. “For example,” the report noted, “we found almost 30,000 records where the description was ‘sets’ or ‘kits’ without any other description. This led us to conclude that the information the agency collected about product descriptions was of such poor quality that it offered very little value.”

Lack of Oversight for Quota-Controlled Goods

The Auditor General’s investigation also considered CBSA and Global Affairs Canada’s effectiveness at enforcing import quotas and collecting duties associated with import permits and licenses. According to CBSA, the Canadian government has established quotas to control the amount of certain goods allowed to enter the country. Affected goods include dairy, chicken, beef, and egg products. CBSA has essentially established a two-tiered level of customs duties for affected products: goods are allowed to enter Canada at a certain tariff rate, but once the volume of goods established by the quota has been reached, subsequent imports of the same goods are subject to a higher rate.

Chicken products are among the items subject to import quotas

In addition, all goods subject to a tariff-rate quota are listed on the Import Control List, as detailed in the Export and Import Permits Act. Importers are required to obtain a permit from Global Affairs Canada to bring affected goods into Canada. If a quota-controlled product arrives at the border without a permit, CBSA will allow the importer five days to obtain one from Global Affairs Canada.

In fact, though, the audit investigation found an alarming number of quota-controlled goods entering Canada without permits and without paying the right amount of customs duties. Based on 2015 records, auditors found importers were able to avoid C$168 million in customs duties that were never assessed. Leading the list were roughly C$81 million in unassessed duties on dairy imports, C$50 million on chicken, and C$15 million on turkey products.

Excessive Time Period for Submitting Retroactive Claims

A recurring theme of the Auditor General’s findings centered around importers’ ability to amend filings and seek monetary adjustments for up to four years after the actual importation. Importers may submit changes to original documentation for any number of reasons, but such corrections usually come with a request for a refund of customs duties or for retroactive application of free trade agreement benefits.

However, the audit found that since CBSA agents do not examine or sample all shipments before release, they must rely on the importers’ accounting information and supporting documentation. This makes it hard for CBSA to verify whether the requested changes are appropriate. During the 2014-15 fiscal year, the agency paid C$136 million in refunds to importers as a result of retroactive changes to import forms.

Failure to Monitor Qualifications of Customs Brokers

Because the importation process is highly exacting and time-consuming, many businesses choose to enlist an experienced customs broker to manage the process on their behalf. Although the shipper remains ultimately liable for documentation and payments made on its behalf, customs brokers are generally very effective at ensuring full compliance and facilitating the clearance process.

“CBSA neither evaluates the accuracy of broker-provided information nor assesses individual broker performance.

According to CBSA, 286 licensed customs brokers currently operate in Canada, and this group manages the compliance process for almost 70 percent of import transactions. However, there can be broad disparities in customs brokers’ competence and capabilities. As revealed by the audit investigation, CBSA neither evaluates the accuracy of broker-provided information nor assesses individual broker performance.

Further, while the agency has the power to suspend or cancel a broker’s license, it has rarely done so over concerns about competency.

Increased Penalties and Heightened Oversight — CBSA Responds

Typical of most audits, the Auditor General’s report included specific recommendations for CBSA to consider in addressing issues identified in the course of the investigation.

Recommendation #1. CBSA should review its customs brokers licensing process and consider implementing: − A licensing process that periodically assesses a broker’s compliance record. − A system of shared liability between licensed customs brokers and importers for compliance with import requirements and duty/tax payments.

- Agency response: CBSA agreed with this recommendation and committed to conducting a review of its customs broker licensing protocols. That review was to have been completed by September 2018.

Recommendation #2. CBSA should review its penalties in order to better protect import revenues and ensure compliance with trade programs.

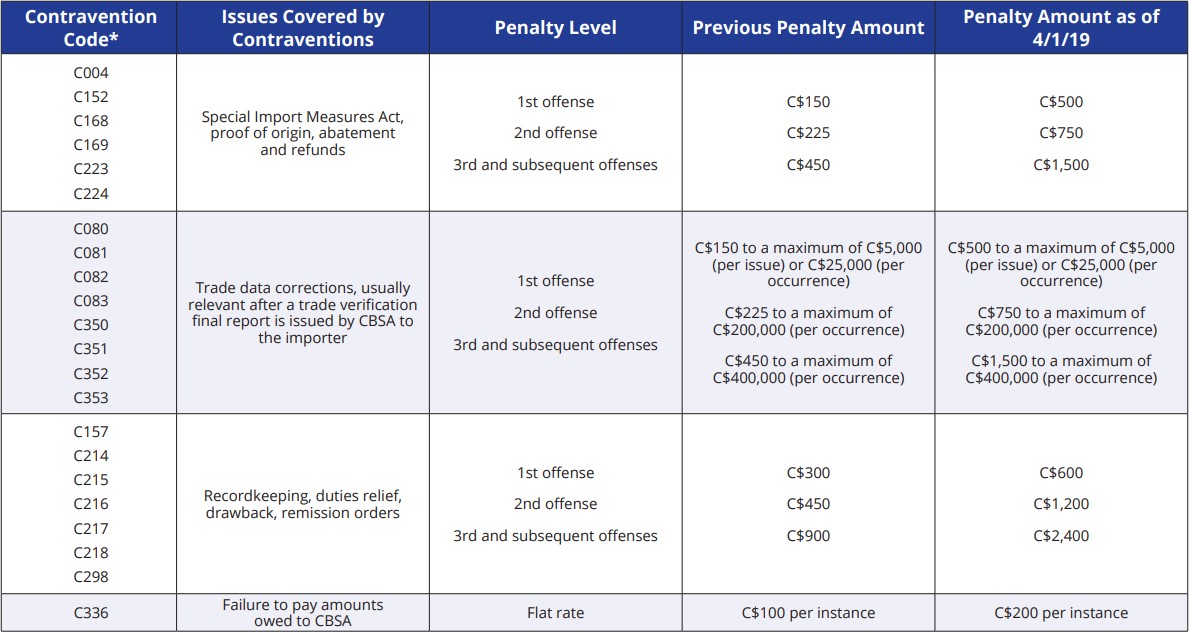

- Agency response: CBSA agreed to explore “further measures aimed at creating a meaningful deterrent to important noncompliance.” In March 2019, the agency announced increased penalties for 22 specific commercial trade-related violations.

That announcement, released in Customs Notice 19-05, noted that “the Auditor General of Canada criticized the CBSA’s Administrative Monetary Penalties (AMPs) for being too low to improve compliance with trade programs” and outlined a new penalty framework. That new framework is presented here:

- C004 – Person provided information to an officer that is not true, accurate and complete.

- C080 – Authorized person failed to make the required corrections to a declaration of origin of imported goods subject to a free trade agreement within 90 days after having reason to believe that the declaration was incorrect.

- C081 – Authorized person failed to make the required corrections to a declaration of origin of imported goods within 90 days after having reason to believe that the declaration was incorrect.

- C082 – Authorized person failed to make the required corrections to a declaration of tariff classification within 90 days after having reason to believe that the declaration was incorrect.

- C083 – Authorized person failed to make the required corrections to a declaration of value for duty within 90 days after having reason to believe that the declaration was incorrect.

- C152 – Importer or owner of goods failed to furnish the proof of origin upon request.

- C157 – Person who imports, or causes to be imported, commercial goods failed to make records and documents in respect to those goods available to an officer when requested.

- C168 – Person failed to report within 90 days a failure to comply with a condition imposed under a tariff item in the List of Tariff Provisions in the schedule to the Customs Tariff.

- C169 – Person failed to repay within 90 days duties and interest refunded under paragraph 74(1)(f) of the Customs Act after a failure to comply with a condition imposed under a tariff item in the List of Tariff Provisions in the schedule to the Customs Tariff.

- C214 – Person failed within 90 days or such other period as may be prescribed to report a failure to comply with a condition of a duties relief provision or remission order.

- C215 – Person failed within 90 days or such other period as may have been prescribed to pay the amount of duties in respect of which relief or remission was granted unless the provisions of subparagraph 118(1)(b)(i) or (ii) of the Customs Tariff were met.

- C216 – Person failed within 90 days after the date of the diversion to report diverted goods to a customs officer at a customs office.

- C217 – Person failed within 90 days after the date of the diversion to pay the amount of drawback and the amount of interest granted.

- C218 – Person failed to pay within 90 days duties relieved under section 89 of the Customs Tariff on the goods that entered into a process that produced by-product(s) not eligible for relief.

- C223 – Customs Self-Assessment (CSA) importer failed to provide a detailed product description in respect of goods liable for review under the Special Import Measures Act (SIMA) after the importer has been notified in writing.

- C224 – Customs Self Assessment (CSA) importer failed to provide the detailed product description within the period specified in respect to goods liable to a Special Import Measures Act (SIMA) action.

- C298 – Person who imports commercial goods or causes commercial goods to be imported failed to provide records in respect of those goods to an officer when requested, within the time specified by the officer.

- C336 – Person failed to pay duties on goods accounted for under subsections 32(2) and 32(3) of the Customs Act.

- C350 – Authorized person failed to pay duties as a result of required corrections to a declaration of origin of imported goods subject to a free trade agreement within 90 days after having reason to believe that the declaration was incorrect.

- C351 – Authorized person failed to pay duties as a result of required corrections to a declaration of origin of imported goods within 90 days after having reason to believe that the declaration was incorrect.

- C352 – Authorized person failed to pay duties as a result of required corrections to a declaration of tariff classification within 90 days after having reason to believe that the declaration was incorrect.

- C353 – Authorized person failed to pay duties as a result of required corrections to a declaration of value for duty within 90 days after having reason to believe that the declaration was incorrect.

Recommendation #3. Unless otherwise specified in a trade agreement, CBSA should review the period allowed for retroactive changes to import documentation.

- Agency response: CBSA agreed to develop options for reducing the amount of time allowed for importers to make corrections “while preserving the agency’s ability to conduct compliance activities.” Currently, in most instances, importers have up until four years after date of importation to amend documentation. The agency committed to completing this process by December 2019.

Recommendation #4. CBSA should work in collaboration with Global Affairs Canada to better enforce tariff-rate quotas by reviewing the process of verifying permits. CBSA should also explore options for automating the process of validating accounting declarations for quota-controlled goods (which are charged a lower rate of duty).

- Agency response: Both CBSA and Global Affairs Canada accepted the audit findings and agreed to adopt tighter enforcement of tariff-rate quotas.

Choosing the Right Customs Expert

U.S. businesses that ship to Canada are liable for all information and documentation supplied to CBSA, even when materials are submitted on their behalf by a customs broker.

This is why a business must have a high level of confidence in the customs broker working on its behalf. However, as the Auditor General’s report makes clear, broad variances exist among licensed customs brokers with regard to competencies and capabilities.

CBSA maintains a current listing of more than 285 licensed customs brokers that collectively oversee the compliance process for almost 70 percent of import transactions. The audit investigation determined though that CBSA does not “evaluate the accuracy of import information provided by individual brokers, nor assess individual broker performance.”

This means it’s up to a potential client to do its homework and ensure that a broker holds itself to the highest standards of professionalism and has mechanisms in place for keeping pace with changing customs compliance mandates and processes. Among the many important considerations in selecting a customs broker, a U.S. importer should ensure capabilities that include:

U.S./Canada Experience. This may seem obvious, but it’s a good idea to use a customs broker that specializes in moving goods between the U.S. and Canada. The two countries have numerous initiatives in place to facilitate the flow of goods, and a business will want to ensure it takes advantage of all time- and money-saving opportunities. Among other issues, a broker that specializes in cross-border transactions will have a full understanding of the North American Free Trade Agreement, its proposed successor (the United States-Mexico-Canada Agreement), and the process for determining benefits eligibility.

Trusted Trader Participant. Make sure you select a broker that participates in U.S. and Canadian “trusted trader” programs. These programs offer expedited clearance opportunities to businesses that voluntarily undergo thorough screening processes and verify the security of their supply chains. U.S. Customs and Border Protection maintains the Customs Trade Partnership Against Terrorism (CTPAT) program, while CBSA administers the Partners in Protection (PIP) program.

Single Window Initiative. CBSA recently mandated use of the Single Window Initiative (SWI). Through SWI, members of the trade community now have a single platform to use when submitting customs-related information and documentation to CBSA and associated government agencies. The SWI is a significant step for CBSA and promises to alleviate many of the bottlenecks and redundancies that stymied previous filing systems. CBSA provided members of the trade community with regular updates about SWI development, including a lengthy “test window” during which traders could acclimate themselves with the new system’s requirements. Make sure you enlist a broker that is fully versed in the SWI so that shipments will move seamlessly through the clearance process.

Thoroughness/Attention to Detail. The Auditor General found as many as 20 percent of shipments arrive at the Canadian border with incorrect tariff classification codes assigned. Improperly classified shipments run the risk of being assessed a higher rate of duty and missing out on free trade agreement benefits. Make sure your broker prioritizes proper tariff classification and takes the time necessary to ensure all required documentation is accurately and thoroughly completed.

Validate Broker Standing with CBSA. At the recommendation of the Auditor General’s report, CBSA agreed to improve oversight of the broker licensing process and to hold brokers liable for poor performance. In the meantime, a U.S. business can ensure a broker’s legitimacy by ensuring it is included on CBSA’s listing of licensed customs brokers. While this listing offers no guarantees about a broker’s competence or capabilities, it does indicate legitimacy and authorization to collect taxes and interact with CBSA.

Conclusion

The Canadian Food Inspection Agency provides a quarterly listing of all shipments arriving at its border that are denied entry. In the fourth quarter of 2018, that list identified 37 such shipments, 15 of which originated in the United States. Shipment contents ranged from luncheon meats, which were refused entry because of noncompliance with Meat Inspection Act regulations; duck fat oil, which was noncompliant with Health of Animals Regulations; and hazelnuts, found to be noncompliant with Plant Protection Act regulations.

While the specifics of these examples may differ, each suffered the consequences of noncompliance with Canadian customs regulations and was not allowed to clear the border. This is certainly not the outcome any U.S.-based shipper wants and is a good reminder of the need to prioritize full compliance with all CBSA requirements.

And if importers need any further reminder, CBSA’s decision to significantly increase penalties sends a clear signal that the agency is serious about enforcement and will hold violators accountable.

Purolator. We deliver Canada.

Purolator is the best-kept secret among leading U.S. companies who need reliable, efficient, and cost-effective shipping to Canada. We deliver unsurpassed Canadian expertise because of our Canadian roots, U.S. reach, and exclusive focus on cross-border shipping.

Every day, Purolator delivers more than 1,000,000 packages. With the largest dedicated air fleet and ground network, including hybrid vehicles, and more guaranteed delivery points in Canada than anyone else, we are part of the fifth-largest postal organization in the world.

But size alone doesn’t make Purolator different. We also understand that the needs of no two customers are the same. We can design the right mix of proprietary services that will make your shipments to Canada hassle-free at every point in the supply chain. Contact us today!